- the World Heritage Exchange Trading Systems

Community sustainability, adaptability and resilience relies on people's ability to access, exchange and make efficient use of available resources. Tourism-dependent communities are specifically vulnerable to disruptions in tourism which could potentially deprive citizens of the income necessary to thrive and/or survive.

We also know that unless we address and solve the inherent unsustainabilty of our current economic, financial and monetary system, we will exhaust our non-renewable resources and fail to avert what the UN warns of: total societal collapse due to breaching of planetary boundaries (‘Global Assessment Report on Disaster Risk Reduction’ 2022).

Decoupling tourism from the extractive economy

Tourism as a transformational pathway needs to decouple the host-visitor relationship from the exploitative and extractive economy and instead support non-exploitative reciprocal exchanges.

Tourism products and services offered within a circular economy - involving both resource and financial circularity - may contribute regenerative development.

Towards circular and regenerative economies

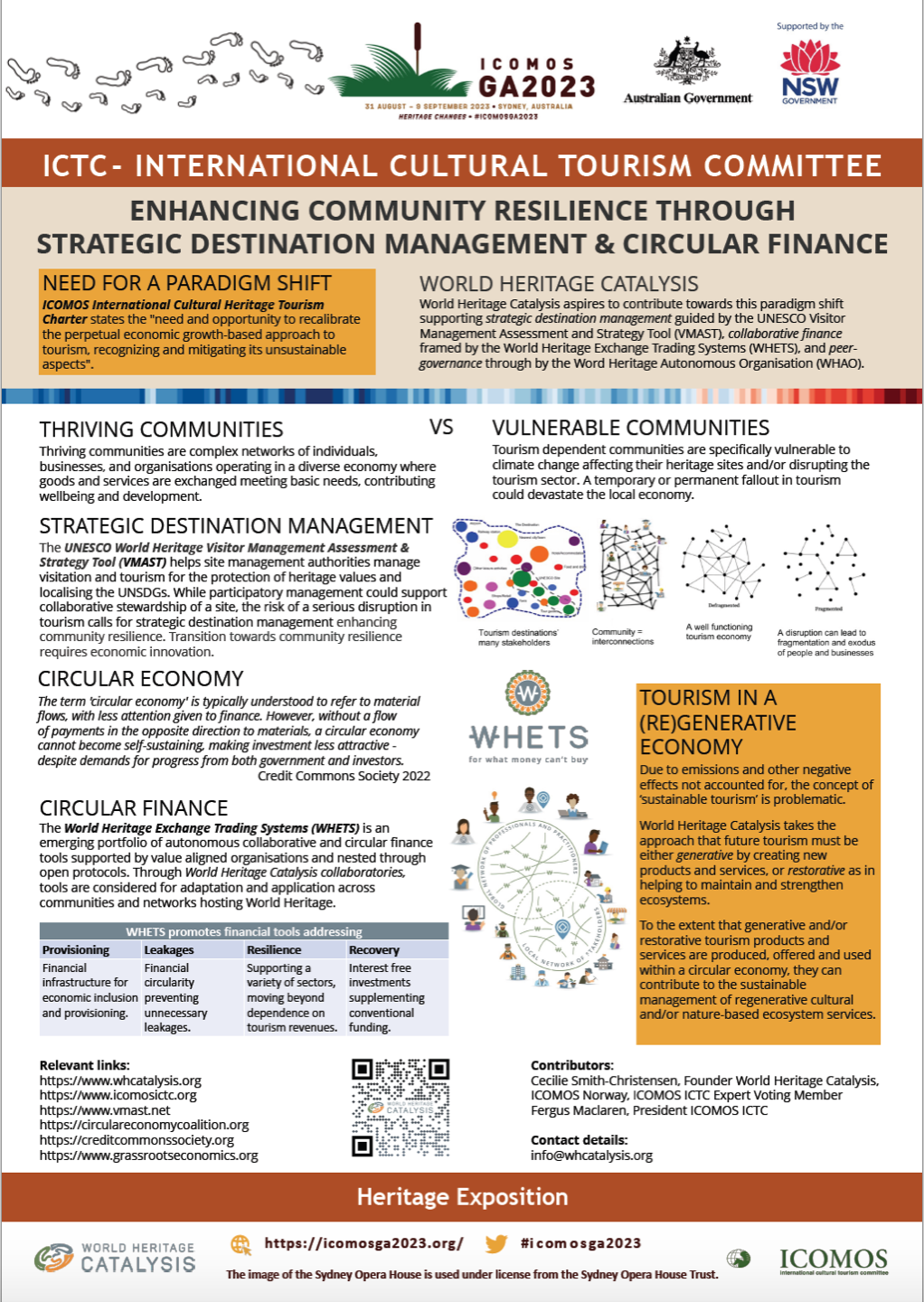

The term 'circular economy' is typically understood to refer to material flows, with less attention given to finance. However, without a flow of payments in the opposite direction to materials, a circular economy cannot become self-sustaining, making investment less attractive - despite demands for progress from both government and investors.

Credit Commons Society 2022

Enhancing economic inclusion and resilience through transformative destination and visitor management

The transformative potential of tourism and visitor management lies specifically in how strategic planning and investments could build infrastructure benefitting host communities. The World Heritage Exchange Trading Systems (WHETS) support the transition towards a circular economy by offering collaborative financial tools to underpin a commons-friendly tourism economy.

WHETS is not one system but an emerging portfolio of circular economics and collaborative finance tools provided through value-aligned organisations. The tools may be adapted and applied across a diversity of communities and networks associated with World Heritage or looking to World Heritage for transformative practice.

The economic tools encompassed by WHETS address several aspects of tourism destinations and hosts communities relating to provisioning, leakages, resilience and recovery.

Site management authorities are specifically encouraged to consider how exchange trading systems set out through WHETS can support and incentivise collaborative implementation of goals and strategic objectives as set out through the UNESCO Visitor Management Assessment & Strategy Tool (VMAST).

Tools for inclusive, circular & regenerative economies

KEY CONCEPTS

The World Heritage Exchange Trading System (WHETS) builds from a rich body of knowledge on how people have exchanged, traded and collaborated for millennia, combined with new technologies that could help scale a circular, commons-friendly and regenerative economy.

Regenerative circular economics

> beyond sustainability

An economic system based on business models that replace the 'end of life' concept by maintaining and keeping living, technical, biological and financial resources in use at their highest societal value at all times for the benefit of future and current generations.

Circular Regions

More info: Circular Regions; Mutual Credit Services; Circular Economy Coalition

Collaborative finance

A category of financial transaction that occurs directly between individuals without the intermediation of a traditional financial institution.

Mutual credit

> the means of exchange in a commons supportive economy

A means of trading, of exchange, that doesn’t require conventional money, doesn’t incur interest and doesn’t involve banks. It’s based on networks of businesses, traders and individuals who get to know and trust each other in a geographical area or business sector.

Applied in a trade network members get an account, set at zero. When they sell, they get credits, when they buy, they get debits. There are limits to how far anyone can go into credit or debit. It’s a means of exchange, but not a store of value, so it can’t be extracted from communities and concentrated.

Access to decentralised credit systems promotes resilience, autonomy, and adaptive capacity.

More info: Credit Commons Society; Mutual Credit Services; Low Impact

Commons credit

> economic regeneration

Inclusive and people powered means of exchange made possible by and supporting the stewardship of natural and cultural commons.

More info: Credit Commons Society

Credit commons

> going global

The Credit Commons is a 'protocol' - a language that allows mutual credit and complementary currency groups all over the world to trade with each other seamlessly, without money.

To form the basis of a new global commons economy all mutual credit based monetary projects could be connected through the Credit Commons Protocol into a global network, but owned and controlled by the communities.

More info: Credit Commons Society; Credit Commons White Paper

CoFi TOOLS

The following tooling are currently encompassed by WHETS.

Credit clearing

> reducing the need for money to clear debt

Credit clearing is something the banks do to reduce the need for money to pay debts. But smaller networks of businesses and individuals can do it too!

Imagine A owes B £10; B owes C £10; C owes A £10. If invoice information or dues are collected systematically, algorithms can clear the maximum amount of debt, minimising the need for money to make the payments.

Living labs: Local Loop North West, UK; Local Loop Merseyside, UK

More info: Low Impact; Mutual Credit Services Clearing Clubs

Trade credit

> financing short term exchange

Businesses already finance each other through trade credit, often extending payment terms of at least 30 days. Pooling and shared acceptance of this credit gives it a ‘mutual’ character, allowing groups of businesses that do a lot of trade together to share risk and finance each other in a coordinated manner. Layered on top of credit clearing, mutual trade credit further reduces the need for money from outside of the community.

Living labs: Coming

More info: Coming

Use-credit obligations

> saving and investing in commons infrastructure

Allows physical infrastructure to be brought into the commons without incurring debt, by issuing vouchers sold at a discount.

Imagine a community energy group wanting to put up a wind turbine. At the moment, to get the funds, they need to go into debt or give away equity (which means the infrastructure will be in the hands of capitalists before long). Instead, they issue energy-credit obligations – vouchers denominated in kWh, not £ (which makes them inflation-proof). People will want them because they’re sold at a discount, and they provide a store of value – interest-free security for old age or sickness. UCOs can work in every sector of the economy.

Living labs: Coming

More info: Low Impact; Mutual Credit Services Trade Clearing Clubs

Capacity vouchers

> allowing consumers to invest spare cash in local retailers

Capacity vouchers can be used to build business-to-consumer systems that allow consumers to invest spare cash in local retailers in return for a discount voucher that represents a claim on the business' spare capacity. The network wide discount is fixed to the smallest profit margin of any participating retailer (mitigating their risk), whilst additional discretionary discounts can be offered by individual business at the point-of-sale. The consumer can use the voucher at any member across the network. Vouchers are cleared between businesses using a shared ledger, with issuance and acceptance limits mutually agreed on the basis of spare capacity.

Living labs: Coming

More info: Mutual Credit Services High Street Vouchers

Community inclusion currencies

In a decentralized digital environment, individuals and associations issue digital vouchers on a public ledger, symbolizing their commitment to deliver specific goods or services, usually valued in a national currency. Pool curators (like community groups) aggregate these vouchers, setting criteria, caps, relative pricing, and overseeing fees and an insurance fund against defaults. Voucher issuers determine supply, redemption specifics, expiration dynamics, and typically reclaim expired vouchers, akin to airtime credits or bus tickets. As these vouchers can exist in multiple pools, their utility expands, enabling broader exchange across interconnected pools. This ecosystem amplifies the vouchers' potential, facilitating diverse exchanges in a decentralized manner.

Living labs: Coming

More info: Grassroots Economics

Collaborators

World Heritage Catalysis acts as a convener between systems providers, site management authorities and the local community. Upon expressions of interest we invite value aligned partners and collaborators to consider each case / community / network on an individual basis, and suggest approaches that could be adapted or developed.

About

An international coalition of value-aligned individuals and organisations with Members in over 30 countries collectively advancing the circular economy through shared tools and resources.

Tools & resources

Activities

About

Activating the eco-system bridging top-down and bottom-up via a suite of practical and effective tools and resources.

Tools & resources

Activities

About

The Credit Commons is a globally-connected network of decentralised, moneyless trading groups. The Credit Commons Society exists to support and promote the use of the Credit Commons Protocol, particularly between local business networks, lending circles (or savings pools) and community currencies.

Tools & resources

About

Mutual Credit Services (MSC) is a burgeoning social franchise dedicated to community wealth building, circular economics, rebuilding the commons and contributing towards a global Credit Commons. Building on credit creation and accounting mechanisms used by the corporate and financial sectors, and by providing access to decentralised credit systems, MCS' helps build an economy underpinned by collaborative finance – where the tools for exchange and investment are controlled by and for value producers in the local economy.

Groups can establish their own governance structures and then voluntarily federate, supporting trade using globally-acceptable credit that remains grounded in local trust relations. As a social franchise MSC provides the necessary support services to each group as determined by their context.

Tools & resources

Multilateral Obligation Set-off

Projects

Shubh Vyapar, India

Svensk Barter, Sweden

Stroud Housing Commons, UK

Sustenance and South West Good Food Network, UK

About

Grassroots Economics is a non-profit foundation that seeks to empower marginalized communities to take charge of their own livelihoods and economic future. We focus on community development through economic empowerment and are dedicated to helping communities realize and share their abundance. While core beneficiaries of our programs include small businesses and people living in informal settlements as well as rural areas, the documentation and tools have been broadly applied worldwide.

Tools & resources

Community inclusion currencies

Sarafu Network

Mwerya

Projects